The yield curve inverted again as we moved into the second quarter of 2019. What does it mean for real estate investors?

What is a Yield Curve?

The yield curve is a graph showing the difference between returns on long term versus short term investments. Normally, shorter-term investments like business loans and merchant cash advances don’t offer as much as longer-term investments which require investors to tie up their capital for longer periods.

These yields are driven by demand. Whichever type of investment is most in demand normally feels yield compression due to returns being bid down, while the lesser preferred type of investments has to offer more yield to offset risk and attract more investors.

What an Inverted Yield Curve Means

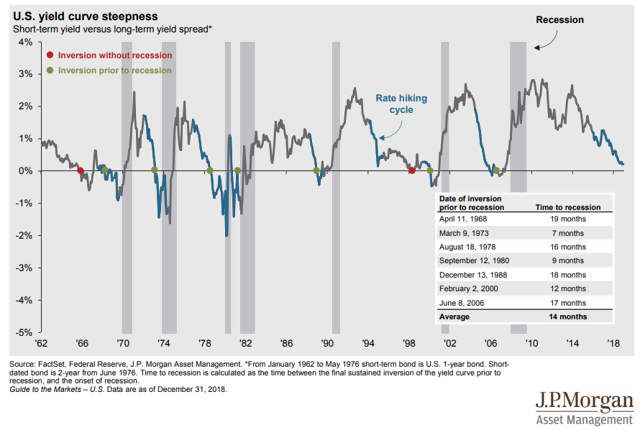

The most significant signal of an inverted yield curve is that it is usually a warning of an impending recession. Not all experts will agree in any given cycle. Though as shown in this graph from JP Morgan, an inverted yield curve has lead to a recession 6 out of 8 times since the 1960s, or as far back as the data goes.

What it Means for Investors

This current trend suggests less confidence in the economy in the short term, which could last through the next election. With yields dropping on investments like bonds and mortgage-backed securities.

In general, this may be a wise time to minimize exposure in the publicly traded stock market and short term commercial business loans. It may also suggest a tougher time for retailers and single family home flippers over the next 18 to 32 months.

Hard, tangible assets are a good choice as are income-producing investments such as apartment buildings. To offset any softness in cap rates and yields, investors can seek out value add opportunities which create superior overall returns.

ABOUT THE AUTHOR

Bill Zahller is the President of Park Capital Properties and resides in Asheville, NC. As a Multifamily Real Estate Investor and Syndicator, he founded Park Capital Properties in 2016 after 14 years involvement in real estate investment. He works with accredited investors and professionals who are interested in real estate investment, diversification, and financial freedom.

Bill has been flying since high school. His father was a Naval Aviator and Captain for TWA. Bill has been flying professionally for over 25 years, 23 of those at his current company. He has accumulated over 12,000 hours and 7 Jet type ratings. He has also held Instructor, IOE Instructor and NRFO pilot positions with a large fractional flight company. He is currently flying the Global 6000 in a long range mission capacity. This keeps it interesting – one week its Beijing or Sydney; the next Rio or Rome.

Bill is also the founder of the Asheville Multifamily Investor Club. Visit www.ParkCapitalProperties.com for more information.